Real Estate Depreciation TReXGlobal.com

version 1.0 |  windows

windows

windows

windows

Name: Real Estate Depreciation TReXGlobal.com

Version: 1.0

Size: 621.87 KB

Category: Applications

License: Free

Released: 2009-03-11

Developer: Www.trexglobal.com

Downloads: 661

Version: 1.0

Size: 621.87 KB

Category: Applications

License: Free

Released: 2009-03-11

Developer: Www.trexglobal.com

Downloads: 661

| Rate this software: |

Description

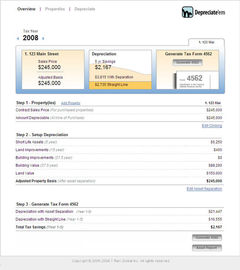

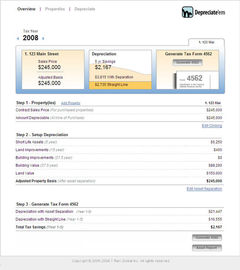

When an investor purchases an income producing asset, like an investment property for their rental business, they don’t get to immediately write off the acquisition cost of the asset. Instead, the cost of the asset must be recovered over the useful life of the asset. This is called depreciation, and the IRS has ruled that residential rental property is depreciable over 27.5 years. Depreciation is a phantom paper expense that reduces your taxable profit.With straight-line depreciation, you get the same real estate depreciation deduction every year, meaning your depreciation deduction in year 3 can be the same as the depreciation deduction in year 23. Accelerating real estate depreciation deductions simply means you deduct more now instead of later. Having a larger deduction now means you have a smaller tax bill now.

People normally depreciate residential real estate using a straight-line deduction over 27.5 years. However, residential properties have shorter-life assets – like a refrigerator or a fence – that can be separated and depreciated sooner over 5 or 15 years using the Real Estate Depreciation Maximizer from TReXGlobal.com, makers of property management software.

Identifying these assets and depreciating them separately allows you to take the deductions sooner. With the accelerated, higher deductions, you can reduce tax liability and save thousands of dollars. There are two main reasons why investors might use straight-line depreciation. One is passive-activity limitations. Fear of depreciation recapture is the other reason.

This real estate depreciation software also includes features that help you calculate depreciable basis and account for closing costs. If you like DepreciateEm Real Estate Depreciation Software for maximizing depreciation deductions on your rental property, be sure to try SimplifyEm Property Management Software at www.TReXGlobal.com to save money on your rental property and property management expenses.

Similar Software

bcTester Barcode Reading and Testing 4.9.0.116Stock Research Lite Word Reader 6.303.1PamFax for Skype 3.4Volutive swCP3 ZoloPages 2.0.3SmarterTicket 2.xReal Estate Price Calculator 3.0.1.5office Convert PowerPoint to Image Free 6.1office Convert Document To Pdf Free 6.1Webolize IssueTracker SubmissionGate Merchant Services Accounts NBL Inventory